Beginning on January 27, 2013, retailers have an option to tack on a surcharge if a customer uses a credit card (limited to 1.5% to 4% of total purchase). Please note, that 10 states do not allow this fee. The 10 states are listed below. The fee doesn’t apply to debit card purchases.

- California

- Colorado

- Connecticut

- Florida

- Kansas

- Maine

- Massachusetts

- New York

- Oklahoma

- Texas

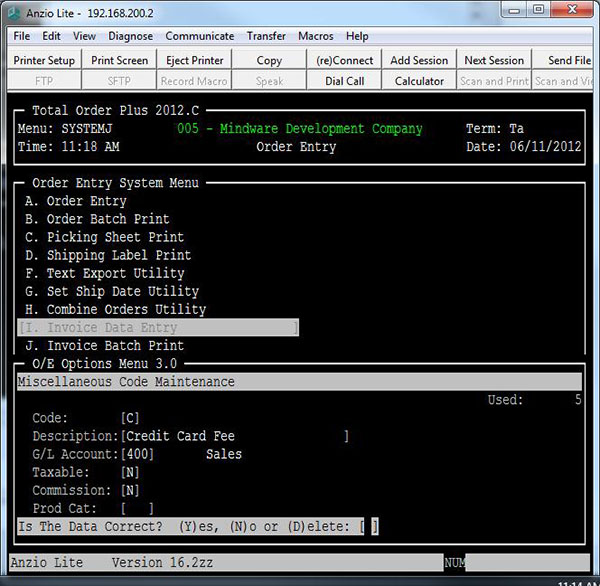

To add this fee to a TOP invoice in Order Entry, you should first setup a Miscellaneous Code for credit card fees. Miscellaneous codes can be added from the O/E Options Menu. Below is an screen example for adding a miscellaneous code for credit card fees.

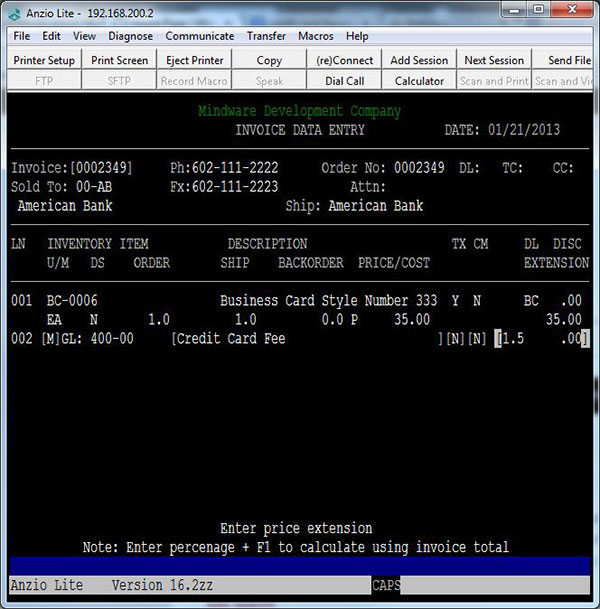

After adding the miscellaneous code, you can use it during order or invoice entry. Just enter MC for the item code (the MC is for Miscellaneous Code), then enter the percentage + the F1 key. See example below.